When it comes to managing financial resources effectively, businesses must weigh their financing options carefully to optimize their capital structure and ensure sustainable growth. two crucial metrics that often serve as the foundation for these decisions are cost of debt and cost of capital. while both metrics are closely intertwined, they are distinct in their purpose and implications. in this article, we’ll explore the fundamental differences between cost of debt and cost of capital, their respective roles in financial decision-making, and how businesses can use them strategically for long-term success.

UNDERSTANDING THE COST OF DEBT

DEFINITION AND COMPONENTS

The term cost of debt refers to the effective rate a company pays on its borrowed funds. In essence, it is the price of debt financing, encompassing the interest payments on loans, bonds, and other forms of corporate borrowing. Since interest paid on debt is typically tax-deductible, the debt’s cost is often calculated on an after-tax basis. This adjustment is important because it reflects the net expense to the company.

FORMULA FOR COST OF DEBT

The formula for calculating the after-tax cost of debt is as follows:

After-tax debt’s cost = (Interest Rate on Debt) × (1 – Tax Rate)

For instance, if a company has a loan with an interest rate of 8% and it operates in a jurisdiction where the corporate tax rate is 30%, its after-tax cost of debt will be:

8% × (1 – 0.30) = 5.6%

This means the actual cost to the company for borrowing funds is 5.6%.

TYPES OF DEBT

Debt financing can take various forms, such as:

- Bank Loans: A common source of short-term or long-term borrowing that requires regular interest payments.

- Corporate Bonds: Issued by businesses to raise funds, where interest (coupon payments) is paid to bondholders.

- Lines of Credit: Flexible borrowing arrangements typically used for day-to-day operational needs.

Every form of debt carries a specific cost based on market conditions, creditworthiness, and risk factors.

UNDERSTANDING THE COST OF CAPITAL

DEFINITION AND COMPONENTS

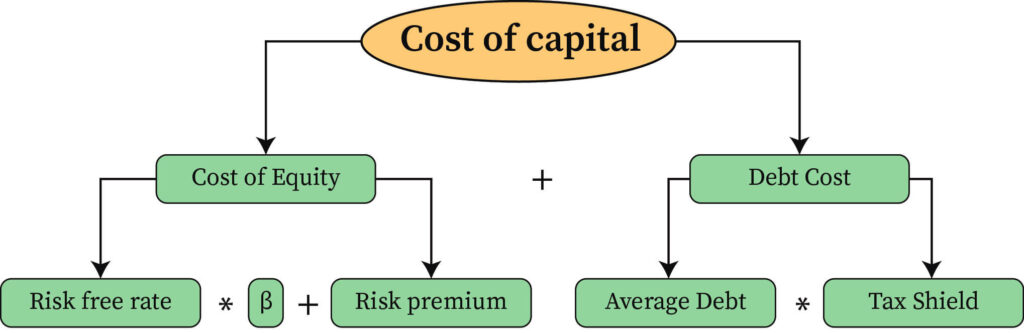

The cost of capital represents the overall cost of funds—whether borrowed or equity—used for business operations and investments. It is a weighted average of the cost of debt and cost of equity, often referred to as the Weighted Average Cost of Capital (WACC). The cost of capital is crucial because it serves as the company’s benchmark for determining the returns required from potential investments or projects.

FORMULA FOR COST OF CAPITAL (WACC)

The Weighted Average Cost of Capital (WACC) is calculated using the following formula:

WACC = (E/V × Re) + (D/V × Rd × (1 – Tax Rate))

Where:

- E = Market value of equity

- V = Total value of capital (equity + debt)

- Re = Cost of equity

- D = Market value of debt

- Rd = Cost of debt

- Tax Rate = Corporate tax rate

The WACC combines both the cost of debt and cost of equity to provide a comprehensive measure of a company’s financing costs.

KEY DIFFERENCES BETWEEN COST OF CAPITAL AND DEBT

While cost of debt focuses solely on the expense associated with borrowing funds, cost of capital incorporates the cost of equity, providing a broader view of a company’s funding requirements. Here are some key differences:

1. SCOPE

- Cost of Debt: Specifically measures the expense of debt financing.

- Cost of Capital: Considers the total cost of financing, including both debt and equity.

2. RISK PROFILE

- Cost of Debt: Typically lower than the cost of equity due to its secured nature and tax benefits.

- Cost of Capital: Higher because equity investors demand a risk premium for their investments.

3. DECISION-MAKING

- Cost of Debt: Useful for evaluating borrowing strategies and assessing whether the company can afford additional debt.

- Cost of Capital: Used to evaluate investment projects and assess their viability relative to the company’s expected returns.

WHY COST OF DEBT AND COST OF CAPITAL MATTER

OPTIMIZING FINANCIAL DECISIONS

Understanding the cost of debt allows businesses to evaluate whether borrowing money is a viable option. For example, low debt’s cost (e.g., during periods of low-interest rates) may encourage a company to finance growth through loans. On the other hand, the cost of capital provides a broader context for decision-making by factoring in the expectations of both creditors and shareholders. By analyzing both metrics, businesses can derive insights into their financing structure and make better-informed choices.

CAPITAL STRUCTURE AND RISK MANAGEMENT

A company’s capital structure—the mix of debt and equity—is critical for long-term stability. If a company relies too heavily on debt, it can face heightened financial risk, particularly during economic downturns. Conversely, excessive reliance on equity financing may dilute existing ownership and lead to higher costs if shareholders demand greater returns. Balancing these components requires a clear understanding of cost of capital and debt to mitigate risks effectively.

REAL-WORLD APPLICATIONS

EXAMPLE 1: INVESTMENT DECISIONS

Suppose Company XYZ is considering a new project that promises a return of 12%. To determine whether this project is feasible, XYZ needs to compare the project’s expected return to its cost of capital. If the company’s cost of capital is 10%, the project can be considered profitable. However, if the cost of capital is 13%, pursuing the project may not be worthwhile as it fails to meet the benchmark return.

EXAMPLE 2: DEBT FINANCING STRATEGY

Imagine Company ABC is exploring debt financing as a means to expand operations. By calculating the debt’s cost, ABC can determine whether its current cash flows can sustain loan payments without jeopardizing its financial health. If the after-tax debt’s cost is 5%, and the company forecasts an annual return of 15% from the expansion, taking on debt may prove advantageous.

EXAMPLE 3: INDUSTRY COMPARISONS

Consider a situation in which two companies in the same industry—Company A and Company B—have differing capital structures. Comparing their cost of capital can reveal insights into their risk profiles and investment strategies, helping stakeholders evaluate which company is better positioned for growth.

CHALLENGES AND LIMITATIONS

FLUCTUATING INTEREST RATES

The cost of debt is highly sensitive to interest rate changes. Rising interest rates can significantly increase borrowing costs, making debt financing more expensive.

MARKET VOLATILITY

The cost of equity, which is a key component of cost of capital, can fluctuate due to market conditions. This makes predicting the overall cost of capital challenging during periods of economic uncertainty.

MISALIGNMENT IN MEASUREMENT

Sometimes, businesses may overemphasize one metric over the other. For example, focusing solely on reducing the debt’s cost might lead to excessive leverage, which can negatively impact the company’s cost of capital and overall risk profile.

STRATEGIC APPROACHES FOR BUSINESSES

BALANCING DEBT AND EQUITY

Companies should strive to create an optimal capital structure that minimizes cost of capital while maintaining financial flexibility. A balanced mix of debt and equity ensures stability and reduces overall risk.

PERIODIC REVIEW OF COSTS

Both the cost of capital and debt l should be reviewed periodically, especially during changes in market conditions, tax laws, or company performance. This allows businesses to adapt their strategies accordingly.

LEVERAGING TAX ADVANTAGES

Since the interest component of debt is tax-deductible, businesses should use this feature strategically to lower their after-tax financing costs.

FINAL THOUGHTS

Both the cost of debt and cost of capital are essential tools for making informed financial decisions. While debt’s cost focuses on the price associated with borrowing funds, cost of capital provides a comprehensive view of financing costs, encompassing equity and debt. By understanding both metrics and their implications, businesses can optimize their capital structure, evaluate investment opportunities, and mitigate risks effectively. In today’s competitive and dynamic market environment, having a firm grasp on these concepts is indispensable for long-term financial success. Whether you’re a corporate executive, investor, or financial analyst, the insights derived from assessing the cost of capital and debt can empower strategic decision-making and contribute to sustainable growth.