Great fintech products don’t just display numbers—they help people decide. From onboarding flows to alerting and portfolio coaching, the best experiences present context at the right moment. If you’re mapping ideas to shippable features, it helps to study concrete patterns that have worked for other teams.

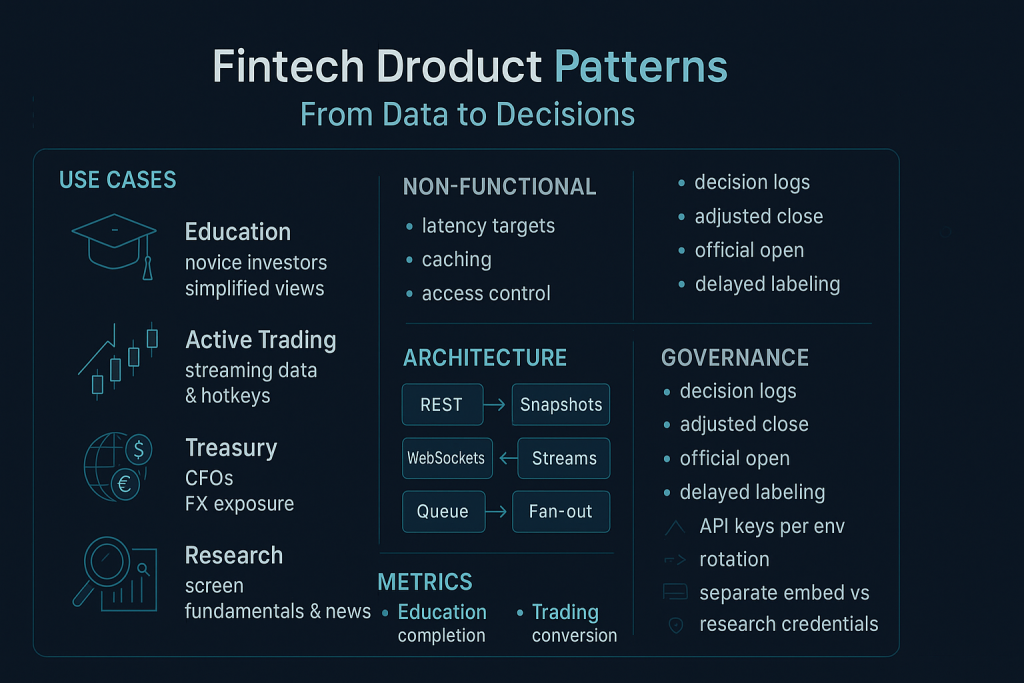

Consider this collection of real-world use-case scenarios. It outlines patterns for common goals: educating novice investors with simplified views, powering active traders with streaming data and hotkeys, giving CFOs consolidated currency exposure, or enabling research teams to screen fundamentals and news in one place. Each scenario translates raw feeds into decisions: when to rebalance, how to size risk, which anomalies to flag, and what to automate.

Use cases also highlight non-functional needs—latency targets for alerts, caching for media pages, access controls for enterprise roles, and auditability for compliance. Engineers can turn these constraints into architecture: REST for snapshots, WebSockets for streams, queues for fan-out, and data lakes for research. Designers can map states for “loading,” “stale,” and “error” to keep trust high, while product managers define success metrics and iterate toward them.

A few concrete blueprints: for education, pair delayed quotes with annotations that explain spreads, gaps, and corporate actions; for active trading, combine streaming prices with server-side alerts and throttle-aware UI updates; for treasury teams, aggregate FX exposures by entity and hedge threshold breaches automatically; for research, cache high-cost aggregates and expose notebooks with reproducible queries.

Each scenario also outlines how to roll out safely: begin with a minimal slice of coverage, add monitoring dashboards, define rollback triggers, and only then broaden instruments and features. By iterating through proven patterns, you increase delivery speed while reducing risk—a balance every fintech team needs to scale sustainably.

Don’t overlook governance. As you add datasets and features, write down decision logs: why you chose specific aggregates, how you calculate adjusted close, what constitutes “official open,” and when you label a feed “delayed.” These small policies prevent regressions as teams change. For privacy and security, scope API keys per environment, rotate them automatically, and separate public embed keys from privileged research credentials.

Finally, connect use cases to measurable outcomes. For example, education flows aim to increase completion rates and reduce support tickets; trading features target alert engagement and order conversion; research tools focus on query latency and retention of power users. Tying scenarios to metrics clarifies priorities and keeps the roadmap honest.