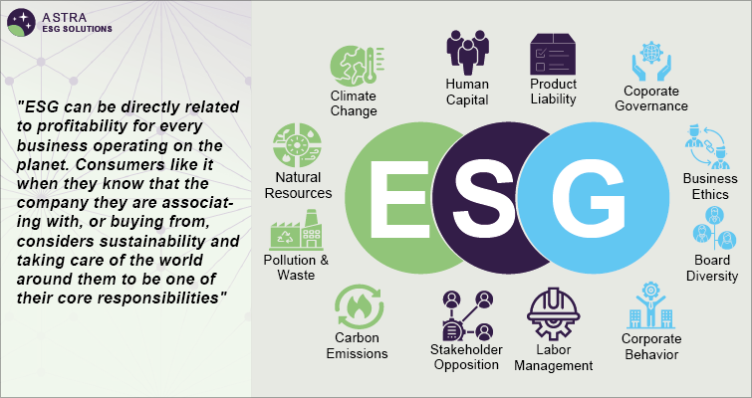

Strong environmental, social and governance (ESG) policies have become instrumental in building a resilient real estate industry supply chain. The trend for green- and smart -buildings have put the spotlight on real estate companies to exhibit a pragmatic approach to sustainability. Policymakers are counting on circular economy principles to foster their ESG rankings. Lately, heightened awareness towards renovation and retrofitting has played its part in conserving resources and minimizing emissions. Investors and lenders have shown an increased inclination for ESG reporting, a lot of shift towards sustainability is likely to be witnessed in the near terms.

Significant progress on climate-based goals will help create long-term value for stakeholders. Commercial real estate organizations have furthered their efforts in ESG management to bolster decarbonization, diversity, equity & inclusion, workplace safety, transparency, ethics & compliance and sound corporate behavior.

The Environmental Impact of the Real Estate Industry

The real estate sector is responsible for consuming approximately 40% of global energy, making it a major contributor to energy consumption and greenhouse gas emissions. The industry’s extensive use of raw materials also has a significant impact on the environment. Rapid urbanization, often associated with the real estate industry, leads to increased water consumption, waste generation, and air pollution. Additionally, the construction sector’s practices, including the sourcing of materials, can contribute to environmental degradation.

ESG and Real Estate

There is a growing awareness among the general public of the impact that ESG factors can have on the real estate industry. This awareness is driving demand for rehabilitation of public spaces, affordable and social housing, and care centers, as well as investments in green buildings. ESG considerations in the real estate industry go beyond environmental concerns and also encompass diversity and social aspects. Sustainable buildings not only benefit the environment but also provide higher return on investment and improved performance through the use of eco-friendly materials and advanced heating and ventilation systems.

The Increasing Necessity for a Sustainable Real Estate Industry

The COVID-19 pandemic has triggered transitions in various industries, including real estate. The industry’s contribution to climate change cannot be ignored, and there is a growing need for sustainable housing that provides long-term benefits. Sustainable housing not only promotes socioeconomic development but also helps preserve the natural environment. Developing markets, in particular, face challenges such as air pollution, water shortages, and changing weather conditions. Opting for greener options in the real estate industry mitigates risks and yields better returns. Transitioning to sustainable design, construction, and operation practices, as well as investing in green buildings, positively impact the climate by reducing emissions, energy consumption, and waste generation.

Innovations Driving Sustainability in the Real Estate Industry

Innovations in green building and construction are taking place globally to make homes more sustainable. Smart buildings, for instance, allow homeowners to monitor and optimize their energy consumption and carbon footprints. Smart systems enhance both safety and energy efficiency. Another notable innovation is the reuse of existing materials, which minimizes waste generation. Innovative building designs are also promoting zero-emission structures.

The Benefits of Green Buildings

Sustainability and green building have been enduring trends in the real estate industry for several decades. Aside from conserving water, energy, and natural resources, green buildings can increase biodiversity and even generate their own energy, making them more environmentally friendly. Furthermore, green buildings have positive impacts on society, the economy, and public health. Environmentally certified buildings produce 62% fewer greenhouse gas emissions than comparable structures. The cost of maintaining green buildings is lower, utility bills are reduced, and occupancy rates are higher. Additionally, eco-friendly construction materials contribute to better health outcomes for building occupants.

Key Risk Factors and Solutions in the Real Estate Industry

The real estate industry encompasses not only land, buildings, and properties but also crops, minerals, and water resources. When analyzing the industry, it is crucial to consider potential risks, such as land contamination resulting from real estate transactions. Contamination can occur due to activities on the land or from external sources. Mold contamination is a significant concern, as toxic molds can cause various health issues. Another dangerous pollutant is radon, a colorless and odorless radioactive gas that can enter buildings through water and air. Mitigating these risks involves optimizing energy usage, adopting cleaner energy sources, promoting green transportation, and implementing waste management strategies such as recycling and resource conservation.

The Growth of the Real Estate Market

In 2021, the global real estate market was worth USD 3.69 trillion, and between 2022 and 2030, it is predicted to grow at a compound annual growth rate (CAGR) of 5.2%.The market’s growth can be attributed to factors such as population growth and the increasing demand for personal household space. As people seek to invest in real estate, it is essential to consider ESG factors to align with sustainability goals.

Key Companies in the Real Estate Industry

Several key players in the real estate industry contribute to ESG initiatives. Some prominent companies include:

- Brookfield Asset Management Inc.

- ATC IP LLC.

- Prologis, Inc.

- SIMON PROPERTY GROUP, L.P.

- Coldwell Banker

- RE/MAX, LLC.

- Keller Williams Realty, Inc.

- CBRE Group, Inc.

- Sotheby’s International Realty Affiliates LLC.

- Colliers

About Astra – ESG Solutions by Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

Need expert consultation around identifying, analyzing and creating a plan to mitigate ESG risks related to your business? Share your concerns and queries, we can help!

You may also like

-

Carbon Dioxide Industry: Embracing ESG for a Sustainable Future

-

World Brand Affairs: Shaping the Future of Global Branding and Marketing Insights with entrepreneur story

-

Why VIP Mobile Numbers Cost More Than Regular Numbers

-

The Ethics of SMS Marketing: Respecting Privacy and Opt-In Practices

-

Indian MLM Software Providers Revolutionize Network Marketing