Business laser checks are becoming increasingly popular for businesses looking to simplify their accounting process. These checks offer numerous benefits, including improved accuracy, security, and cost efficiency. In this guest post, we’ll discuss how laser checks for businesses can help streamline your accounting process and the advantages of laser checks for accounting. Also, strategies and tips for optimizing the use of laser checks. We’ll also offer advice on selecting the right laser check provider for your business.

Understanding the Operation of Business Laser Checks

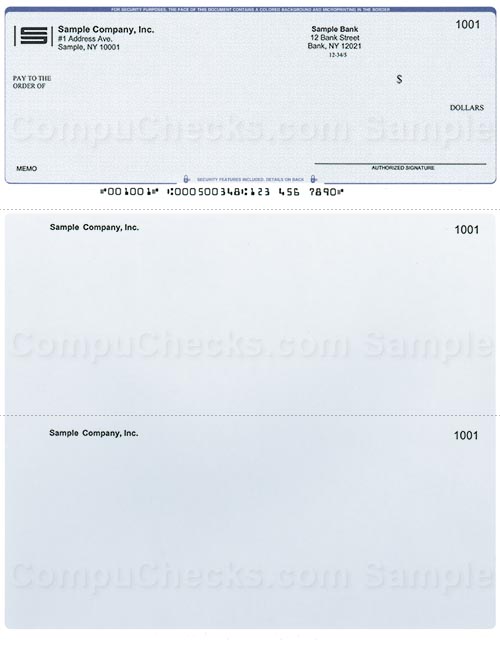

Business laser checks are a type of check that is printed using a laser printer. They are typically used by businesses for payroll and other financial transactions. Laser checks are designed to be highly secure and are customizable to include features like watermarks, microprinting, and other security measures to help prevent check fraud.

The operation of laser checks involves the use of a laser printer that is specifically designed for check printing. These printers are equipped with magnetic ink character recognition (MICR) toner, which is a special type of ink that is used to print the routing and account numbers on the bottom of the check. MICR toner is used because it is highly resistant to tampering and counterfeiting.

To print a business laser check, the user inputs the check information into their accounting software, which generates the check data. The user then loads blank check stock into the printer and prints the check using the MICR toner.

The printer then cuts the check to the correct size, and the check is ready to be signed and distributed. In general, businesses use laser checks to streamline their financial transactions because it is a very secure and effective process.

Significance of Business Laser Checks

Laser checks for business are an important tool for companies that need to make financial transactions. They are highly customizable and offer several security features that help prevent check fraud, making them an essential part of any business’s accounting process. Laser checks can be printed on demand, eliminating the need to keep a large stock of pre-printed checks, which can be expensive and difficult to manage.

In addition to being secure, laser checks are also cost-effective. They can be printed in bulk and on-demand, reducing the need for pre-printed checks and the associated storage costs. Laser checks can also be customized with a company’s logo and other branding elements, which can help increase brand recognition and prevent check fraud.

Overall, business laser checks are significant for their ability to streamline accounting processes, increase security, and reduce costs. They are a valuable tool for businesses of all sizes, helping to ensure that financial transactions are completed accurately and efficiently.

Advantages of Laser Checks for Accounting

Laser checks offer several advantages for accounting processes. First and foremost, they offer increased security features, such as watermarking and micro printing, to help prevent fraudulent activity.

Additionally, laser checks are customizable, allowing businesses to add their logo or other branding elements to their checks. This not only helps with brand recognition but also helps prevent check fraud.

Laser checks are also more cost-effective than traditional checks, as they can be printed in bulk and on-demand, reducing the need for pre-printed checks and the associated storage costs.

Finally, laser checks are more efficient, as they can be printed from any computer, eliminating the need for manual check-writing. This may save you time and minimize the chance for errors. Overall, using laser checks for accounting processes can improve security, reduce costs, and increase efficiency for businesses.

Strategies to Optimize Your Accounting Process with Laser Checks

Laser checks can offer several advantages to optimize your accounting process, including increased security, efficiency, and cost-effectiveness. Here are some strategies to help you optimize your accounting process with laser checks:

- Use custom laser checks with your company’s branding and security features to prevent fraud and ensure authenticity.

- Set up automatic check printing to save time and increase efficiency in your accounting process.

- Utilize software that integrates with your laser checks to streamline record-keeping and reconciliation.

- Print laser checks in bulk to save on printing and shipping costs.

- Consider using check printing software that allows for MICR encoding to further increase security and accuracy.

By implementing these strategies, you can optimize your accounting process with laser checks and save time and money while ensuring the security and accuracy of your financial transactions.

Tips for Choosing the Right Laser Check Provider

When it comes to choosing a laser check provider for your business, there are several factors to consider. Here are some tips to help you choose the right laser check provider for your company:

- Reputation: Look for a provider with a good reputation for quality and reliability. Examine online testimonials and seek out references from other companies.

- Customization: Choose a provider that offers customization options for your laser checks, such as adding your logo, business information, or specific security features.

- Security Features: Ensure that your provider offers advanced security features, such as watermarks, microprinting, and security toner, to protect your checks from fraud.

- Compatibility: Check that the provider’s laser checks are compatible with your printer and software system.

- Pricing: Compare pricing from multiple providers to ensure that you are getting a fair price for the quality of the laser checks.

- Customer Service: Look for a provider with excellent customer service that can assist you with any questions or concerns you may have.

- Turnaround Time: Consider the provider’s turnaround time for delivering your laser checks, especially if you need them on a tight deadline.

By taking these factors into consideration, you can choose the right laser check provider for your business and ensure that your checks are of the highest quality, security, and customization to meet your company’s unique needs.

FAQ’S

- What are the benefits of using business laser checks?

- How do I order business laser checks?

- How do I print business laser checks?

- How do business laser checks help with record-keeping?

Conclusion

Laser checks for business can be an effective tool for simplifying your accounting process. With their convenience, accuracy, and security, laser checks can help you streamline your accounts and manage your finances more efficiently. Ultimately, the decision of whether to use business laser checks should be based on your individual situation, budget, and needs. Regardless, this technology provides a reliable, cost-effective option for managing your accounts and keeping your business finances organized.